If there is an increased medical risk, it is not always easy to take out a life insurance policy. Insurers can reject the application. DH Reinsurance wants to prevent people from being uninsured against their will. We have been active as a reinsurer since 1905. More and more insurers are finding out about us. That is a good thing because the more people who know about DH Reinsurance, the greater the chance that people who are ill or have been ill can take out a good life insurance policy.

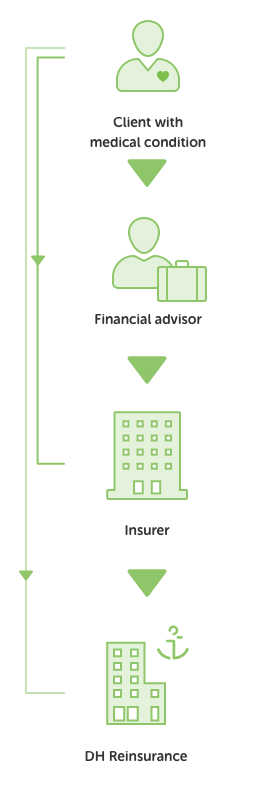

No, that is not possible. We are a reinsurer. Insurers can assign life insurance to us if there is an increased medical risk. As a client you will not notice this, but in this way we make it possible for insurers to accept you as a client.

We are a small, accessible organization with short lines of communication. We work quickly and professionally. We process requests from insurers immediately and can accept more than 90% of the submitted applications. This means that most people with a medical condition can be insured through us.