Determining the premium for a life insurance policy is not easy. There is a whole world of statistics and calculations behind it. At De Hoop, we specialise in assessing applications for life insurance for people with a medical condition. We determine a premium based on the data of the person making the application and using tables and empirical data that we have collected over the many years that we have existed. The probability of mortality and the nature of the medical condition determine the amount of the premium. We would like to provide an overview of how this works.

You take out life insurance because you want to prevent your partner, children or loved ones from facing financial difficulties if you die. The probability of death determines the amount of the premium. To calculate this, (re)insurers use mortality tables that show the average mortality probabilities for men and women at a certain age. These tables are made by the Actuarieel Genootschap (Dutch Actuarial Society) on the basis of figures from the Centraal Bureau voor Statistiek (CBS). These probabilities are used to calculate the premium.

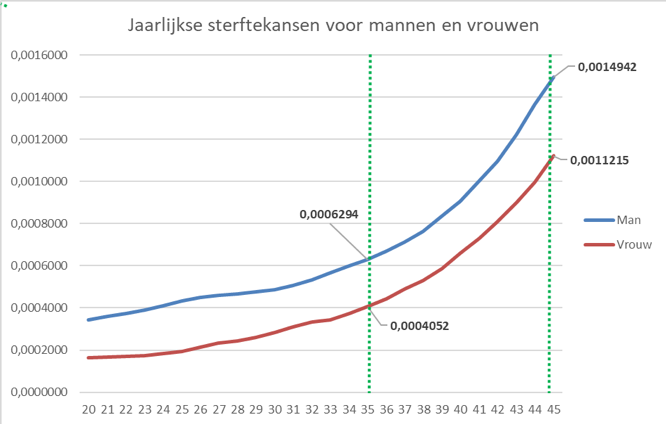

In a graph it looks like this:

You can see in the graph that the probability a 35-year-old man dies is more than 1.5 times greater than the probability a 35-year-old woman dies. You also see that the probability for a 45-year-old man is about 2.3 times greater than for a 35-year-old man. Sex and age are therefore determining factors in determining the risk of mortality. In relation to sex, however, there are European regulations in force that forbid premium differentiation based on gender. This is called gender neutrality. In practice, this means that every insurer works with a certain ratio between men and women. Each insurer is free to determine how this ratio is determined. De Hoop also assumes gender-neutral rates.

What if a 35-year-old man wants to take out insurance for an amount of €200,000 upon death. The premium that the insurer wants to receive is at least 200,000 times the probability of mortality that applies to a person aged 35. Because no distinction is made between men and women, it is determined what percentage of men have an life assurance policy and what percentage of women. In this example, we assume 70% male and 30% female. The probability of mortality in that year is then: 0.7 x 0.0006294 + 0.3 x 0.0004052 = 0.000562. The minimum premium that the insurer wants to receive is then = 200,000 x 0.0005620 = 112.43 euros per year. This premium is also known as the net premium. On top of the net premium is a cost surcharge related to fixed costs that the (re)insurer incurs for personnel, facilities, etc. In addition, other surcharges may be charged. In any case, De Hoop charges a surcharge for the medical condition, which is explained below.

If you have a medical condition, such as diabetes, COPD or heart problems, you have a higher risk of mortality than average. If you are a diabetic, for example, then the type of diabetes you have determines the risk of mortality. Moreover, not only does it depend on whether the medication works well, but even more important is how well you follow the advice of your doctor. This actually applies to all conditions. The level of the additional risk of mortality will be assessed on a case-by-case basis. If your risk of mortality is twice as high as that of someone of the same age with “normal health”, the premium will also increase by a factor of two. After all, you are twice as likely to die.

De Hoop itself keeps the data of all people with medical conditions who are insured. This is used as a guide for estimating the risk. In addition, each file is always viewed separately by our experienced medical advisors. The consultants often also use scientific studies, especially for conditions that are less common. They are also aware of the most recent developments (such as new treatment methods, medicines, etc.). This makes De Hoop completely up to date. Moreover, De Hoop can immediately adjust the assessment of the risk by means of this person-oriented working method. This is an important difference in comparison with the procedures of other (re)insurers. They usually use manuals, in which the premiums for each medical condition are fixed. De Hoop believes that every client is unique. By looking directly at the client’s file, we often can give a lower estimate than the one based on the manuals of the (re)insurance companies.

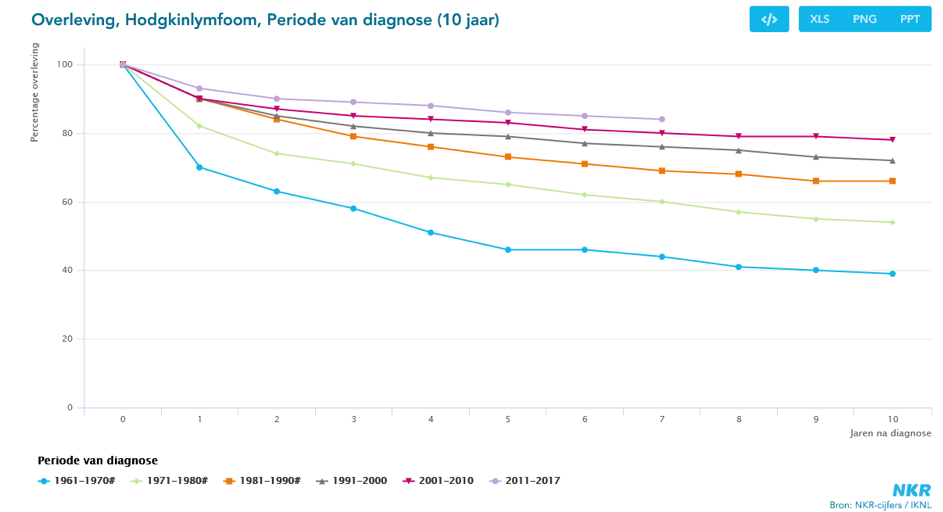

Very high premiums mainly occur in people with a medical condition who are still in the treatment phase or who have recently completed treatment. For these policyholders, we use survival graphs that have been drawn up on the basis of studies into the relevant disease.

Below is a survival chart for Hodgkin’s lymphoma, a cancer. This graph shows what percentage of the diagnosed persons are still alive after 10 years. A breakdown has been made according to the period in which these data were recorded. In the graph you can see that in the period 2001 to 2010 almost 80% are still alive after 10 years. This survival rate is included in the determination of the premium.

We are aware that we cannot provide complete information about an exact premium calculation. It is a matter of customisation and many factors play a role in medical conditions. However, the basic principle at De Hoop is that we strive to ensure that as many people as possible can take out life insurance. This is especially important for people with a chronic illness or medical condition. In a limited number of cases, a medical risk cannot be insured and someone must be rejected. Fortunately, thanks to our customised routes, we can offer good life insurance for 96% of the applications we receive. Whether someone can or wants to pay the premium is another matter. In any case, we try to do everything we can to keep the premium as low as possible because we do not want people to be uninsured against their will.